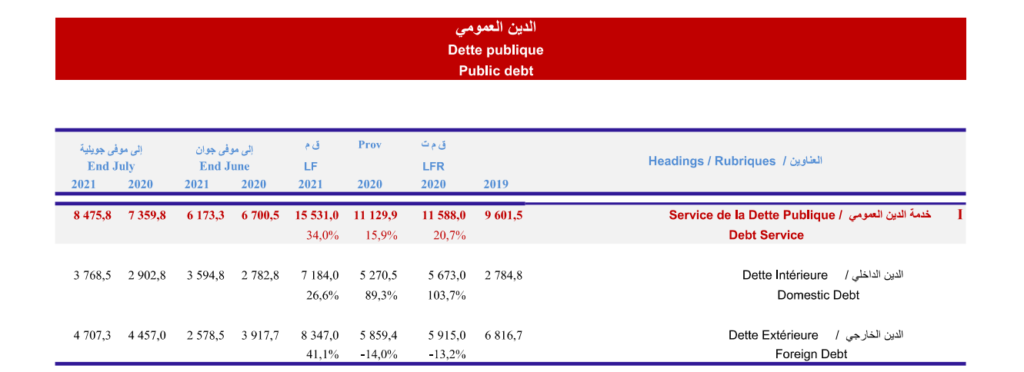

According to the State Budget Execution Report released by the Ministry of Economy, Finance and Investment Support, the outstanding public debt amounted to 99.1 billion.

This public debt is grouped into two main categories: 39% domestic debt and 61% external debt.

According to the same source, 61.4% of debts are in euros, 21.6% in dollars, 10.3% in Japanese yen and 6.7% in other foreign currencies.

For more details, “JDD Tunisia” contacted the economic expert Ezzedine Saidane who explained that: “each month the Ministry of Economy, Finance and Investment Support publishes a report which groups together the expenses and revenue.For the figure relating to public debt (99.1), it is considered one of the most important figures especially as international rating agencies such as Moody’s and Fitch Ratings, for example, which lower the sovereign rating of the Tunisian economy classify Tunisia in the phase of excessive debt. “

Recall that Fitch Ratings and Moody’s downgraded Tunisia’s rating to B3. On February 23, Moody’s downgraded Tunisia’s long-term sovereign rating from B2 to B3, and it also maintained the outlook for this rating to “negative.” Fitch Ratings downgraded Tunisia’s sovereign rating to “B – ” , on July 8, 2021.

Saidane added: “Tunisia is classified in a phase of excessive debt. By excessive indebtedness we mean doubting the ability of the state to repay the debt normally. In addition, it should be mentioned that a downward rating 9 times since 2011 has been awarded to the Tunisian economy “

As for the expert Moez Joudi, he said that “The Tunisian debt is in a difficult and dangerous situation, even explosive. This increase in debt can cause solvency problems (the ability to pay or repay a certain amount of money). 99.1 billion is an official figure but it should be mentioned that there are other unofficial debt values that are being calculated every day. “